As mentioned in previous articles, it is of the utmost importance to take the profitability of a hedging decision into account as point of departure. For this reason we will be looking at the direct input costs of various crops. The historic seasonal price movement of white maize and sunflower is also analysed to optimise the timing of hedging.

Input costs:

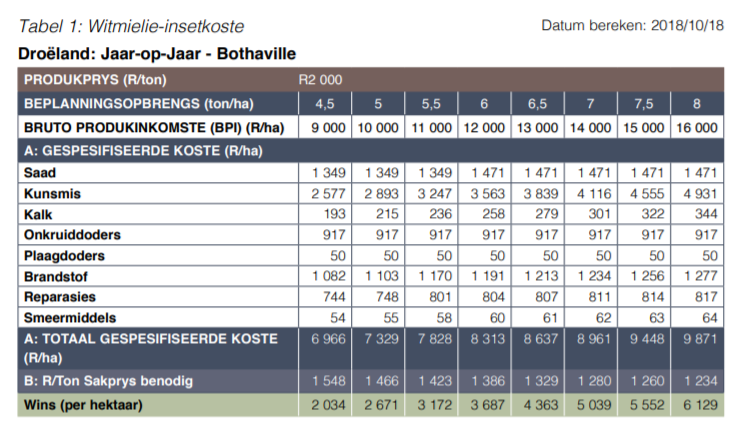

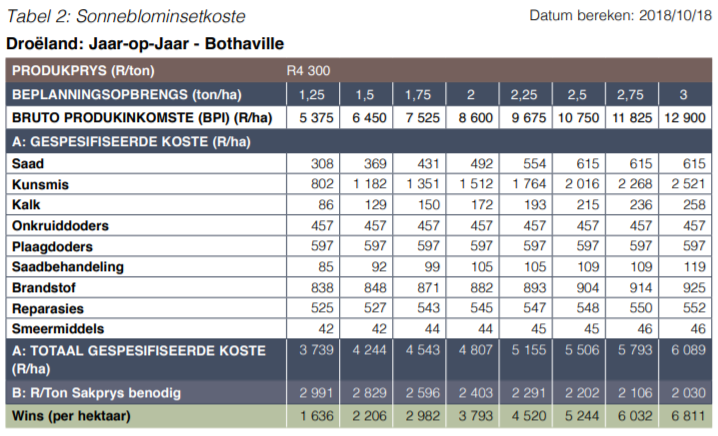

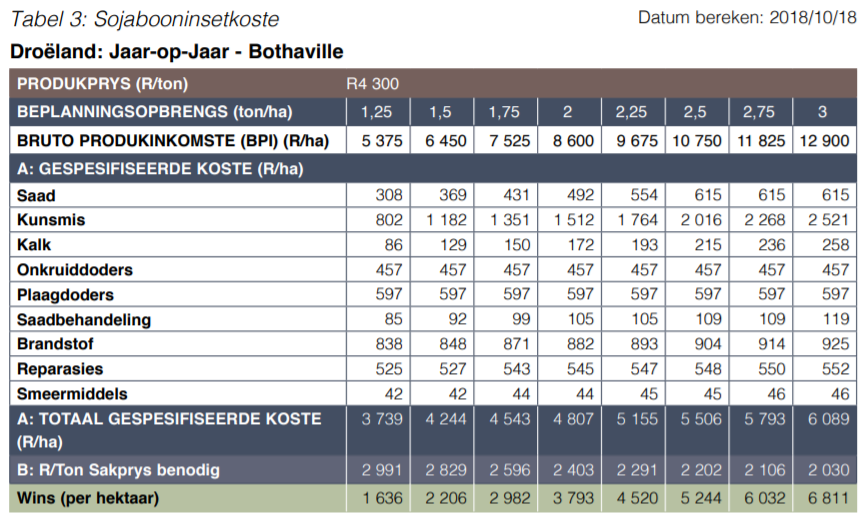

We will be looking at the input costs of white maize, sunflower and soybeans in the Bothaville district. The white maize input costs are as follows:

It is evident from the above figures that crops can be planted profitably this season, measured against current prices at the time of the writing of this article. In order to ensure profitability, hedging has to be done. The hedging can be done optimally by doing it at certain seasonal peaks.

Seasonal trends:

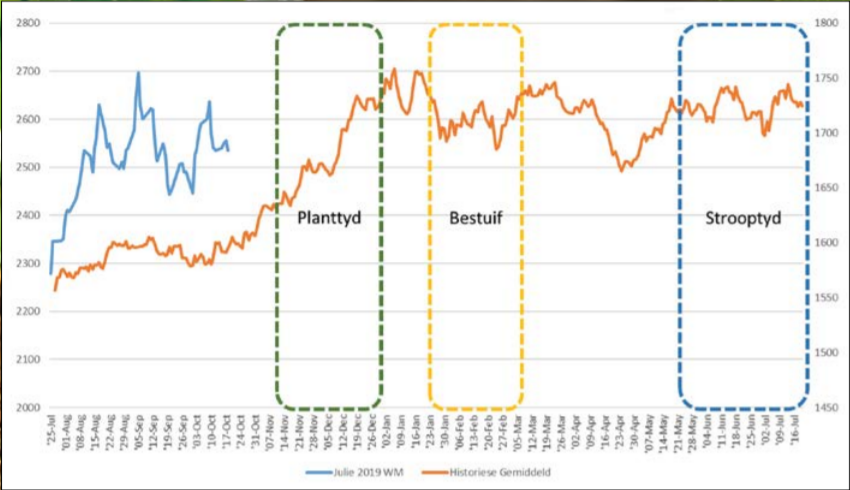

Patterns form over years which clearly indicate periods during which hedging can probably be done at better levels than during other times. In order to identify such times, the average historic price movements were analysed. These seasonal trends can be used to identify times during which hedging can probably be done at good seasonal levels.

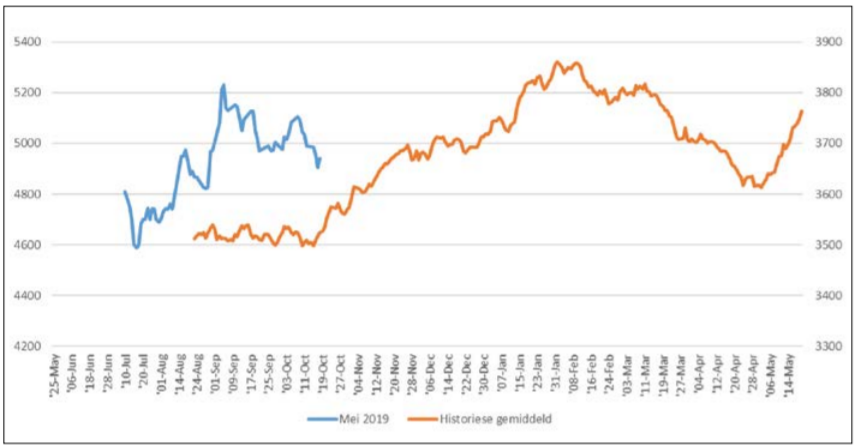

Graph 1: July WM Seasonal

It is evident from the above graph that the first seasonal opportunity to price, is the last half of December. The second opportunity is the first two weeks of March. The last good opportunity is indicated as the first week of June - just before harvest time.

Graph 2: May sunflower seasonal

It is evident from the sunflower graph that the seasonal peak for sunflower is usually at the end of January. It may therefore be sensible not to leave hedging until harvest time, but to do early marketing.

Summary:

The market provides traditional seasonal opportunities for hedging at profitable levels. It is always sensible to utilise these opportunities as effectively as possible with a suitable strategy such as a minimum price, which still leaves room to utilise upward potential. Should the seasonal opportunities be used, hedging can be done at optimal seasonal levels.